You know what’s crazy? The world of finance is changing every single day.

New opportunities, new challenges, and new rules emerge. And you have to keep up with all of it, or you’ll fall behind.

However, there’s a way to stay on top of your game. A way that’s easy, fast, and automated.

This guide will show you that way. It’ll also help you dominate the finance industry.

Run along! Let’s show you how to use WhatsApp for your finance business.

What are the different ways you can use WhatsApp for your financial business?

Meta provides three different ways to engage customers on WhatsApp:

- Consumer (regular) WhatsApp

- WhatsApp Business

- WhatsApp Business solution API (which includes API, chatbot, and live chat)

How do they function in the real world? And what are their features, upsides, and drawbacks?

Let’s find out.

Method #1: Consumer (normal) WhatsApp for finance business

This is just the regular WhatsApp app everyone uses.

It lets you send text messages, voice notes, images, videos, documents, and more. You can also make voice and video calls and create groups.

How does it work?

You first have to register your phone number. Then you can create a profile with your name and photo.

Next, you can add contacts from your phone. Or even scan QR codes to start chatting with them. You can also use WhatsApp Web to locate your chats from your computer.

But how does the normal WhatsApp work in the finance business?

Here’s a scenario.

Imagine you’re a financial advisor. You need to follow up with a client about a new investment opportunity.

You can use Consumer WhatsApp to follow up on the proposal document.

You can send a quick message like this:

“Hi, Mr. Advik. I hope you received the documents I sent you yesterday. Please let me know if you have any questions or concerns. I would be happy to assist you with the next steps.”

Uses of consumer WhatsApp in finance

WhatsApp in finance is used for the following:

- Answer customer questions with speed and flair.

- Keep customers updated about their account activities and alerts.

- Send tailored promotions and offers to your loyal customers.

- Let customers book appointments with you without hassle.

Benefits of using Consumer WhatsApp for your finance business

Consumer WhatsApp offers benefits like:

- Wide reach: WhatsApp has over 2 billion users worldwide. That’s where your customers are.

- Personal touch: Direct messaging personalised relationships with clients and prospects.

- Real-time engagement: Timely response to customer inquiries and issues. And,

- Cost-effectiveness: Consumer WhatsApp is free and accessible to everyone.

Sounds great, right? Well, unfortunately, the normal WhatsApp isn’t perfect. It has major limitations.

Drawbacks of using Consumer WhatsApp for your finance business

Consumer WhatsApp has some drawbacks that you should be aware of. Its major drawbacks include:

- Limited features: You won’t have access to amazing features like chatbots and payment gateways

- Data management: Difficulty managing customer data manually, and

- Scalability: Without automation, it can be daunting to manage a large customer base. Especially during peak periods.

Reevaluate your needs before you jump on to the Consumer WhatsApp.

Or better still, check out its alternatives for better functionality.

Consumer WhatsApp alternatives for your finance business

You can overcome the cons of using Consumer WhatsApp. Alternatives for your financial business are:

- WhatsApp Business

- WhatsApp Business Solution API

This leads us to the second method, which is the first alternative.

Methods #2: WhatsApp Business for finance business

WhatsApp Business operates much like its simpler cousin except with some added perks.

You can still send messages, voice notes, images, and videos. But now, you can also organise your chats into segments called labels. As well as set up automated messages called quick replies.

WhatsApp Business lets you build a business profile. This way, you get to interact with your audience as a business.

Plus, you can log up to 4 different users into the same WhatsApp Business account. This applies to businesses with multiple employees or team members.

For example, you have clients who have taken loans.

You can create labels for different loan categories. Like, personal, business, or mortgage labels.

The quick replies feature handles this perfectly. Customers can use it to confirm the payment status, the due date, and the interest rate.

This way, you can reduce the risk of default. Plus, it’ll improve customer satisfaction while streamlining your accounting process.

Uses of WhatsApp Business in finance

You can use WhatsApp Business to:

- Foster personalised interactions with your clients.

- Provide prompt and efficient support with real-time messaging.

- Locate the right customers with relevant messages and promotions.

- Gather customer feedback to enhance your products and services.

Benefits of using WhatsApp Business for your finance business

Here are some of the benefits of using WhatsApp Business for your finance business:

- Enhanced customer experience: Keep your clients happy and loyal with personalised attention.

- Timely complaint resolutions: Address concerns promptly and resolve issues efficiently, and

- Increased customer retention: Stronger relationships lead to long-term loyalty.

- Better features than normal WhatsApp: This means smarter customer interactions.

However, like the consumer WhatsApp, it has some drawbacks.

Drawbacks of using WhatsApp Business for your finance business

With WhatsApp Business, you’ll face hassles like:

- Security and privacy issues: WhatsApp may share your data with third parties, such as Facebook.

- Technical problems: Challenges like network failures or server outages. These can affect your communication with your clients when they need you the most.

- Limited scalability: WhatsApp Business works well for small and medium-sized businesses. You need additional tools to manage a large or international customer base.

Looking at these cons, what, then, is the best alternative?

WhatsApp Business alternatives for your finance business

The answer is simple: you need a WhatsApp Business API.

Method #3: WhatsApp Business API for finance business

We live in a fast-paced world of finance. Every day, numbers dance across your screen. And deals are sealed faster.

You need a more advanced and scalable solution for your finance business. Something that eliminates the drawbacks we discovered in the previous methods.

WhatsApp Business API makes messaging a breeze. It’s best suited for large businesses with a wider audience.

With WhatsApp Business, you can build chatbots to automate your customer conversations. Sending notifications, documents, images, videos, and more became easier.

WhatsApp API also tracks your clients’ data and preferences. So, you can personalise your messages and offer them amazing services.

For example, you have a client who wants to invest in a certain stock.

You can send them automated messages with the latest price, performance, and analysis of that stock.

And, if they decide to buy or sell? You can confirm the transaction with a secure link. All within minutes and without leaving the app.

Benefits of WhatsApp Business API for finance business

Here’s why WhatsApp Business is a game-changer for your finance business.

- Customer satisfaction increases: WhatsApp Business gives customers the VIP treatment they deserve with tailored messages.

- Solve problems faster: No more waiting on hold or sending emails. Just converse with intelligent chatbots and fix issues in minutes.

- Keep them returning: Build trust and loyalty with regular updates and offers.

- Enjoy more features than regular WhatsApp: Send invoices, receipts, documents and more with ease.

Are there drawbacks? Let’s examine them together.

Drawbacks of WhatsApp Business API for finance business

Some disadvantages of using WhatsApp Business for your finance business include:

- It requires technical expertise, which can be a hassle if you’re not techy.

- You need an official account from a verified provider. This involves a verification process and a fee that may vary depending on your region and business size.

How do WhatsApp Consumer app, Business app and Business solution (API) compare?

Here’s a summary of how each method compares with the other.

| Features | Consumer (Normal) WhatsApp | WhatsApp Business | WhatsApp Business Solution API |

| Basic messaging | ✅ | ✅ | ✅ |

| Business Profile | ❌ | ✅ | ✅ |

| Product Catalogue | ❌ | ✅ | ✅ |

| Quick replies | ✅ | ✅ | ✅ |

| Automated notifications | ❌ | ✅ | ✅ |

| Customer chatbots | ❌ | ❌ | ✅ |

| Advanced analytics | ❌ | ❌ | ✅ |

| Integrations (plus 3-P integration) | Limited | Limited | Extensive |

| Pricing | Free | Free | Paid |

| Scaling | Limited | Limited | Scalable |

| Ease of team collaboration | Easy | Easy | Technical expertise required |

| Conversation transfer | Limited | Limited | Seamless |

WhatsApp Business Solution API wins this one. So, get started ASAP and automate your WhatsApp messaging.

WhatsApp financial templates

Here are WhatsApp templates (and examples) you can draw inspiration from.

Service requests and booking templates

Use this template for service requests and bookings:

Template: You have successfully booked {service_name} for {date} at {time}. The total amount due is {amount}. Please make the payment by using the link below before {deadline}. If you have any questions or need to reschedule, kindly contact us at {phone_number} or {email_address}.

Example: You have successfully booked XYZ Tax Services for March 15 at 10:00 am. The total amount due is $200. Please make the payment by using the link below before March 10. If you have any questions or need to reschedule, kindly contact us at 555-1234 or xyz@tax.com.

Delivery & order tracking services

Use this template for delivery and order tracking:

Template: Hi {customer_name}, your order {order_number} has been shipped and is expected to arrive on {delivery_date}. You can monitor your order status here: {tracking_link}. Thank you for choosing us.

Example: Hi John, your order 123456 has been shipped and is expected to arrive on 30 Nov 2023. You can monitor your order status here: https://example.com/track/123456. Thank you for choosing us.

Timely transaction notifications

Use this template for transaction notifications:

Template: Hi {Name}, we have received your payment of {Amount} for {Product/Service}. Your transaction ID is {ID}. Thank you for shopping with us.

Example: Hi Alice, we have received your payment of $50 for the online course. Your transaction ID is 123456. Thank you for shopping with us.

Scheduling and rerouting

Use this template for scheduling and rerouting:

Template: Hello {name}, this is a friendly reminder that you have a payment of {amount} due on {date} at {time} for {reason}. Kindly ensure you have enough funds in your {account} to avoid any fees or penalties. Thank you for choosing our service.

Example: Hello John, this is a friendly reminder that you have a payment of $500 due on November 30th at 5:00 PM for your car loan. Kindly ensure you have enough funds in your checking account to avoid fees or penalties. Thank you for choosing our service.

Upselling and cross-selling

Use this template for upselling and cross-selling:

Template: Hi {Name}, thank you for choosing {Product} for your {Goal}. I’m happy to inform you that we have a special offer for you: if you upgrade to {Product Plus}, you can enjoy {Benefits} for only {Price} more per month. This is a great opportunity to get more value from your investment and achieve your {Goal} faster. Would you like to learn more about this offer?

Example: Hi John, thank you for choosing MoneySaver for your retirement plan. I’m happy to inform you that we have a special offer for you: if you upgrade to MoneySaver Plus, you can enjoy higher returns, lower fees and more flexibility for only $10 more per month. You’ll get more value from your investment and achieve your retirement goals faster. Would you like to learn more about this offer?

Feedback & complaint management system

Use this template for feedback and complaints:

Template: Dear {customer_name}. Thank you for your feedback on our {service_name}. We appreciate your honest opinion and always seek ways to improve our customer experience. We are sorry to hear that you had a {problem_type} with our {service_name}. Please reply to this message with your {case_number}, and we will get back to you with an update within {time_frame}. Thank you for choosing us and for your patience.

Example: Dear John. Thank you for your feedback on our personal loan service. We appreciate your honest opinion and always seek ways to improve our customer experience. We are sorry to hear that you delayed receiving your loan approval. Please reply to this message with your case number, 123456, and we will get back to you with an update within 24 hours. Thank you for choosing us and for your patience.

Request referrals

Use this template for request referrals:

Template: Hi {name}. Thanks for choosing {company}. We value you. Please refer us to others who need our services. You’ll get a {reward} for each referral. Share this link: {link}. They’ll get a {discount} on their first transaction.

Example: Hi John. Thanks for choosing MoneySaver. We value you. Please refer us to others who need our services. You’ll get a $10 cashback for each referral. Share this link: https://moneysaver.com/referral. They’ll get a 5% discount on their first transaction.

Marketing

Use this template when marketing your products or services:

Template: Hi {name}, this is {sender} from {company}. We have a special offer for you: {offer}. To claim it, reply with “YES” before {deadline}. Take advantage of this opportunity to save money and achieve your financial goals.

Example: Hi John, this is Lisa from Moneywise. We have a special offer for you: a 10% discount on our premium financial coaching service. To claim it, just reply with “YES” before Friday. Take advantage of this opportunity to save money and achieve your financial goals.

What is the WhatsApp API use case for the financial organisation?

You can easily set up a WhatsApp API for these functions.

I. Opening of accounts & KYC updates

Customers can easily submit their documents, verify their identity, and complete the registration via WhatsApp. This reduces the hassle of visiting branches or filling out online forms.

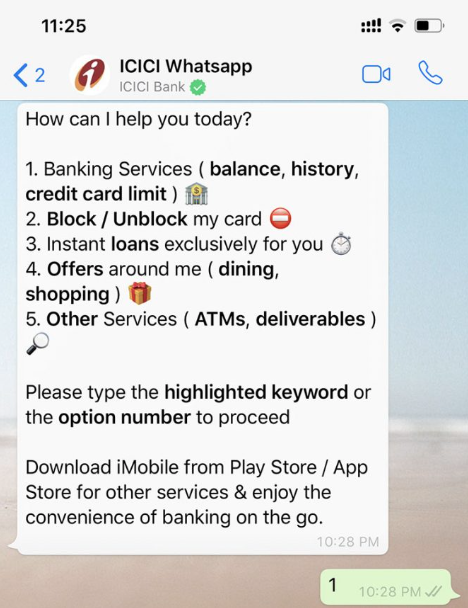

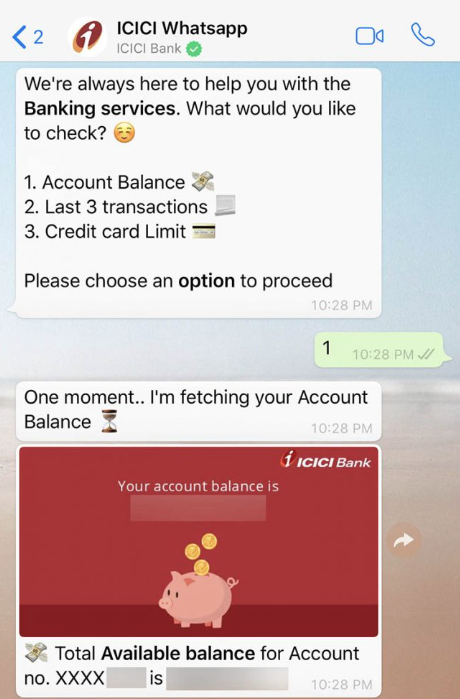

II. Notifications and alerts

WhatsApp can notify customers about their account balance, payment due dates, transaction confirmations, and security alerts. This helps customers stay informed and secure.

III. Credit card-related actions (fraud alerts)

WhatsApp can alert customers about suspicious transactions, ask them to confirm or deny the charges and block the card if needed. This enhances customer protection and satisfaction.

IV. Secure document sharing

WhatsApp uses end-to-end encryption to guarantee that only the intended recipients can access the documents. This is useful for sharing sensitive information such as contracts, invoices, receipts, and statements.

V. FAQ responses

WhatsApp can answer common queries about interest rates, fees, policies, and procedures. This saves time for both customers and agents and improves customer experience.

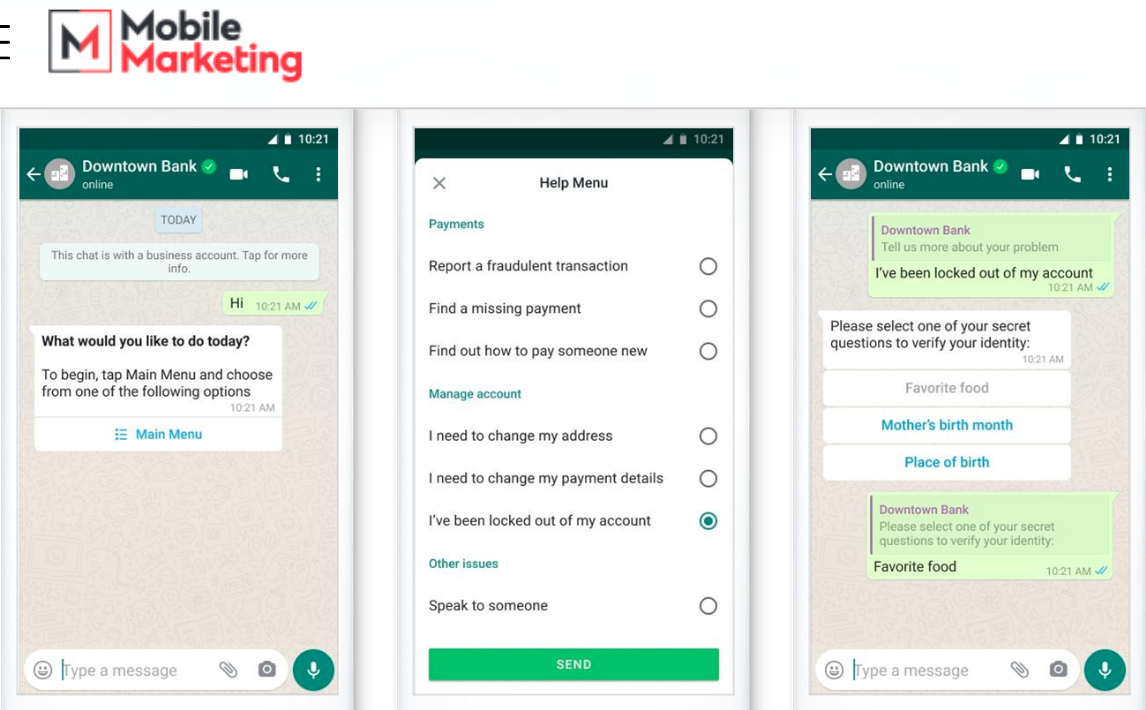

VI. Account management

WhatsApp API can also facilitate account management for customers. For example, WhatsApp can allow customers to check their account balance, transfer funds, pay bills, and request statements through simple commands. This provides convenience and accessibility for customers.

VII. Investment advice

WhatsApp chatbots can also provide investment advice to customers. For example, you can share market insights, trends, and strategies with customers based on their preferences and goals. This helps customers make informed decisions and achieve their financial objectives.

VIII. Loan applications

WhatsApp can be used to receive and process loan applications in a fast and convenient way. Customers can send their documents, verify their identity, and get instant feedback through WhatsApp. This reduces the waiting time and paperwork involved in loan approvals.

IX. Personalised financial services

You must meet the needs and preferences of customers. And a WhatsApp API guarantees this. It gives you deep insight into customer behaviour, preferences, and feedback.

X. Security and authentication

WhatsApp uses secure end-to-end encryption. This protects the privacy and security of messages and calls. It also supports two-factor authentication. This amplifies security when logging in to financial accounts or services.

XI. Customer support

WhatsApp enables financial institutions to provide quick and efficient customer support. Customers can use WhatsApp to ask questions, report issues, or request assistance. Financial institutions can use WhatsApp to respond to inquiries, resolve problems, or provide guidance.

XII. Customer advocacy (feedback and loyalty programs)

WhatsApp gathers feedback from customers and improves their satisfaction. You can use WhatsApp to send surveys, ratings, or reviews to customers and gather their opinions and suggestions. As well as to reward loyal customers with offers, discounts, or rewards.

XIII. Chatbot for 24/7 service

A chatbot is a software program. It can stir up a conversation with a human user. You can use a WhatsApp chatbot to provide round-the-clock financial assistance. It can handle routine inquiries like balance checks, transaction history, or account updates. It can also direct customers’ complex issues to human agents.

XIV. Regulatory compliance

You must comply with various regulations when using WhatsApp for financial services. Obtain customers’ consent to communicate with them through WhatsApp.

XV. Prospect follow-up

For example, a potential customer has completed a form on your website. Ask them on WhatsApp if they have any questions or need any help. The WhatsApp API allows you to send rich media messages. Like images, videos, documents, or locations, to enhance the customer experience and provide relevant information.

How WhatsApp helped these finance companies boost sales

Here are two success stories of how finance businesses used WhatsApp to grow their revenue, improve their service, and streamline their operations.

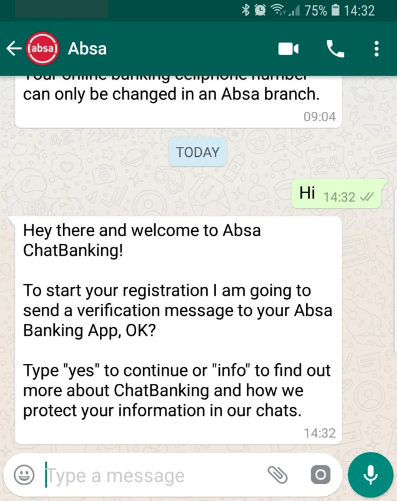

1. Absa Bank, South Africa created ChatBanking for hassle-free banking on WhatsApp

Imagine you could do all your banking tasks with just a few taps on your phone. No more waiting in line, no more filling out forms, no more hassle.

Sounds too good to be true, right? Well, not for Absa Bank’s customers.

Absa Bank leads a number of financial institutions in South Africa.

They wanted to make banking easier and more accessible for their customers.

So, they launched ChatBanking.

They used ChatBanking to handle transactions within WhatsApp, like checking account balances, transferring money, and paying bills.

Customers no longer need to visit branches or use other channels.

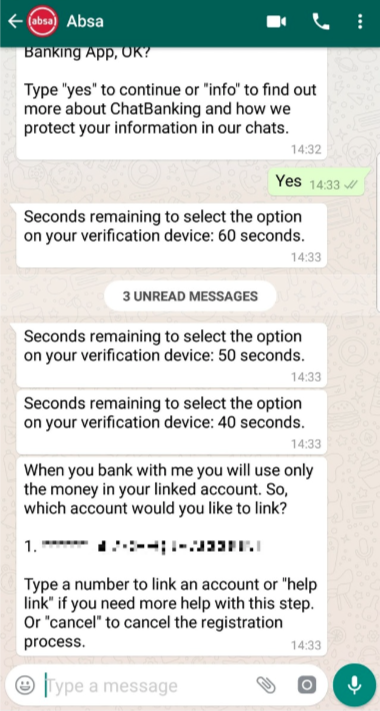

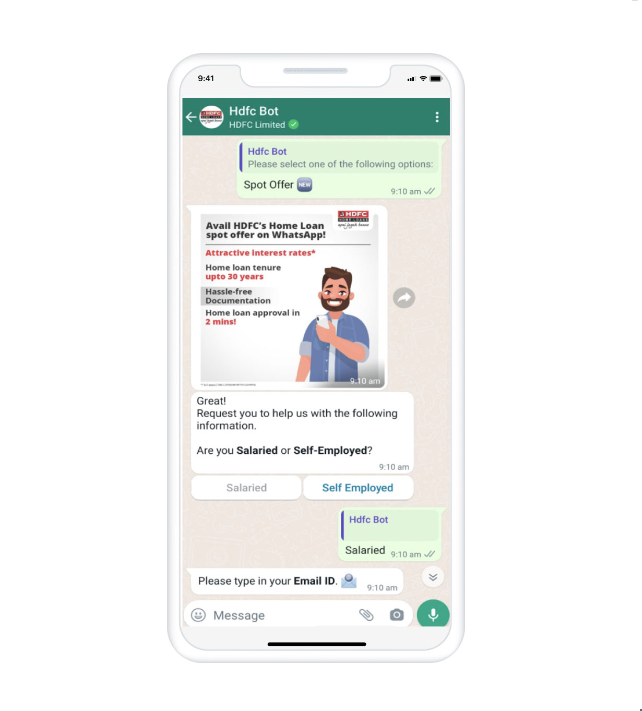

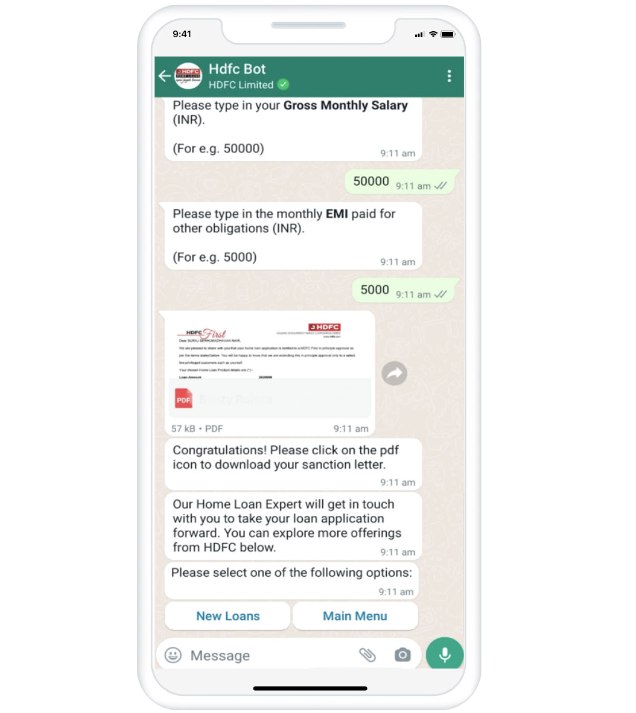

2. Housing Development Finance Corporation (HDFC), India, tailored financial advice on WhatsApp

Imagine you’re a financial expert. You help thousands of people achieve their dream of owning a home.

But how do you reach them? How do you make them trust you and listen to your advice?

That was HDFC’s challenge as a top Indian housing finance company.

They needed to connect with their customers on a more personal level. They soon discovered the power of WhatsApp.

They used the WhatsApp Business API to create a WhatsApp chatbot.

They could engage customers with investment tips and even start the home loan application process. All within the app they use every day.

The results were amazing.

Customers loved the convenience and simplicity of getting financial guidance through WhatsApp.

They felt more confident and informed about their decisions. And they were more likely to apply for a home loan through HDFC.

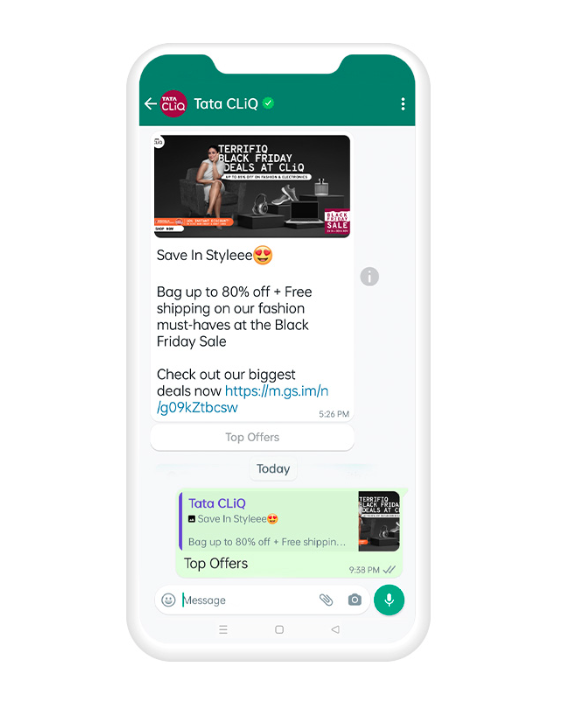

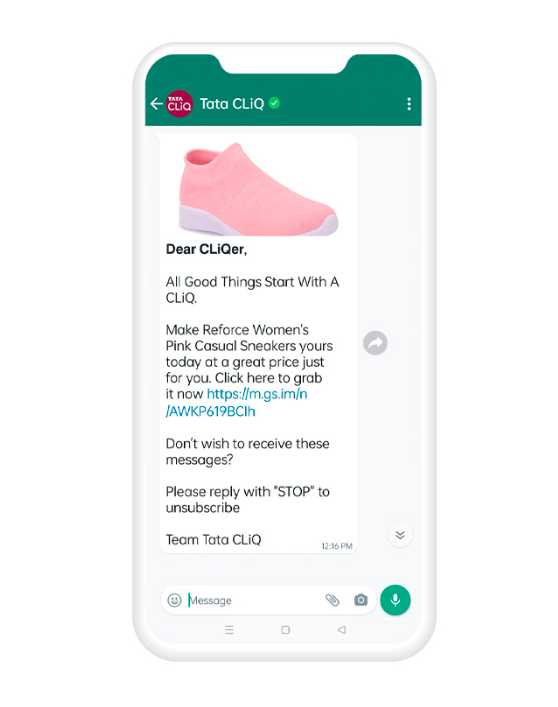

3. Tata CLiQ, India, increased online sales with WhatsApp alerts

It was the festive season in India. And Tata CLiQ, one of the country’s top online shopping sites, wanted to make the most of it.

Email and SMS weren’t cutting it. And Tata CLiQ needed something more direct, more engaging, more convenient. They needed WhatsApp.

They used WhatsApp to send automated alerts to customers, with exclusive deals and curated product suggestions.

The messages were relevant, timely, and respectful. Tata CLiQ used humour and personality to make the messages more appealing.

The results were astonishing.

With automated WhatsApp alerts, customers were 1.7x more likely to purchase on the Tata CLiQ website. They saw a huge increase from their previous campaigns.

Tata CLiQ was thrilled with the outcome, and so were their customers, who appreciated the convenience and value of WhatsApp.

How to integrate WhatsApp into business strategy for the finance industry

Retaining customers requires more than just a friendly face.

Here’s how Telebu Social can nurture your customer relationships:

- Conversational customer service: Telebu Social lets you personalise experiences on WhatsApp, Instagram, and Facebook.

- Nurturing relationships: Telebu Social’s chat interface fosters genuine connections. Share market updates, offer financial tips, or send birthday greetings.

- Closing leads faster: Telebu Social helps you create powerful tools like chatbots. Now, you can instantly answer pre-sales questions, qualify leads, and schedule appointments.

So wait no more. Get started or schedule a free demo with Telebu Social.

Our sales team is waiting to walk you through it.

FAQs

How can financial advisors leverage WhatsApp Business API?

WhatsApp Business API is a compelling tool that allows financial advisors to communicate with their clients in a fast, convenient and secure way. With WhatsApp Business API, financial advisors can send personalised messages, share documents, confirm appointments, provide updates and more. WhatsApp Business API enables financial advisors to create chatbots that can automate common queries and provide instant responses.

Is there any cost involved in using WhatsApp Business API?

WhatsApp Business API is free for the first 1,000 messages per month. After that, there is a small fee per message, depending on the destination country. You can find more information on the pricing page of WhatsApp Business API.

Is WhatsApp Business API secure for financial transactions?

Yes, WhatsApp Business API is secure for financial transactions. WhatsApp uses end-to-end encryption to safeguard the privacy and security of your messages. Only you and the person you communicate with can read or listen to your messages. Nobody, not even WhatsApp, can access your messages.

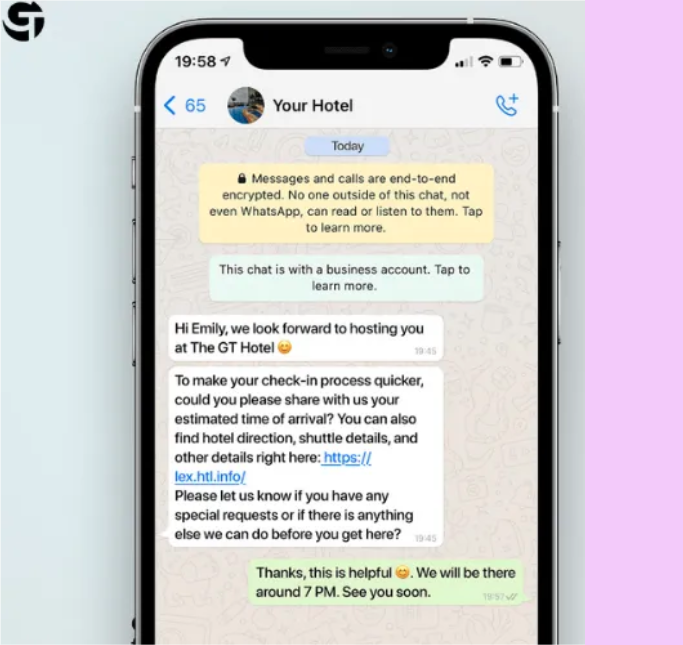

What type of notifications can I send to my guests with WhatsApp Business?

WhatsApp Business allows you to send various notifications to guests, such as booking confirmation, check-in instructions, payment reminders, itinerary updates, feedback requests and more. You can also use WhatsApp Business to send rich media messages, such as images, videos, audio and location. WhatsApp Business helps you enhance your guest experience and increase your customer loyalty.

0 Comments